The New Reality of BFSI Leadership in the AI Age

In today’s Banking, Financial Services, and Insurance (BFSI) landscape, customer expectations have outpaced traditional models of service. Where people’s financial health is just as important and personal as their physical health, customers have some of the highest expectations.

BFSI customers aren’t just looking for faster service, they’re looking for flawless, white glove level of service.They expect quick resolutions, airtight security, proactive fraud alerts, and guidance that feels tailor-made for their unique financial situation. And they expect all of that across every channel, from the branch to the app to the call center, without having to repeat themselves.

Here’s the problem: most automation-only strategies can’t deliver on those expectations. Chatbots alone can’t explain why a mortgage rate changed or guide a customer through a sensitive insurance claim with empathy. That’s why the real winners in BFSI aren’t the ones replacing agents with bots, they’re the ones turning their agents into augmented problem-solvers with AI that works alongside them.

AI isn’t your agent’s enemy; it’s their competitive edge. And the organizations using it this way are quietly outperforming everyone else.

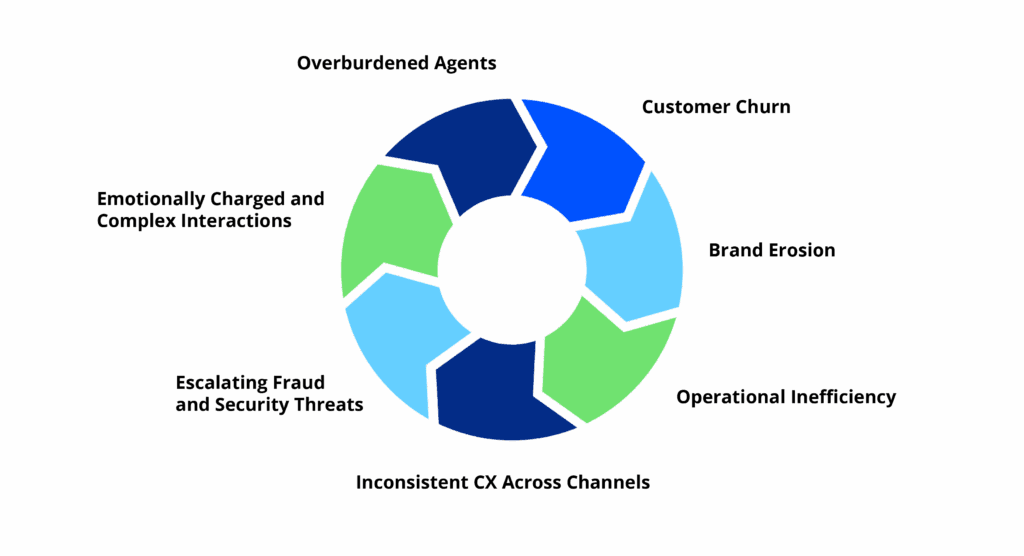

What Pain Points Are BFSI Leaders Struggling With?

Before we look at the relationship between humans and AI, it’s important to understand the challenges faced by contact center leaders in the BFSI space. Unlike retail or travel, every customer interaction in BFSI carries regulatory weight, emotional intensity, and direct financial consequences. When a customer’s money, claim, or financial security is at stake, expectations skyrocket and the margin for error disappears. Here are the most pressing challenges shaping the future of BFSI contact centers:

Customer Churn

Consumers today judge banks and insurers as much on experience as on products. PwC found that nearly 80% of consumers say experience is as important as offerings, and human support is key to that perception. Without empathy in critical moments, customers don’t just get frustrated; they leave. And in banking, when a customer exits, they take multiple accounts, cards, and future loans with them.

Brand Erosion

Every poor bot interaction chips away at an institution’s reputation. In finance, trust is not just “nice to have”; it is the product. Bain & Company found that a 5% boost in retention can increase profits by 25–95%. Losing even a fraction of loyal customers because of a soulless bot interaction can cost millions in lost lifetime value.

Operational Inefficiency

What looks efficient on paper can backfire in practice. McKinsey reports that up to 60% of bot-handled interactions in BFSI escalate to humans because the bot fails to resolve the issue. This creates double work; customers repeat themselves, and agents start from scratch. What was meant to save costs actually bloats them.

Inconsistent CX Across Channels

Today’s customer doesn’t stick to one channel. They start with mobile, switch to chat, and escalate to a call. Yet most automation is siloed. Gartner found that 70% of customers expect companies to deliver consistent experiences across channels and when this doesn’t happen, it drives dissatisfaction and churn.

Escalating Fraud and Security Threats

Contact centers in BFSI are high-value targets for fraudsters. Between 2024 and 2025, digital fraud increased by ~21% in financial services (Veriff). Leaders must balance rigorous identity verification with smooth, low-friction customer experiences. One misstep can either compromise security or alienate legitimate customers, both of which come at a high cost.

Emotionally Charged and Complex Interactions

Conversations around denied loans, lost funds, or disputed claims are not transactional. They are personal and emotionally intense. These situations demand empathy, discretion, and human judgment, none of which bots can replicate. At a time when customers are emotionally attached to a financial brand 39% more likely to adopt new services, 32% more likely to seek advice, and are ~49% more likely to increase balances (BAI), leaders need effective resources.

Overburdened Agents

Bots often deflect the easy questions, leaving agents with only the hardest, most emotionally charged cases. Yet without AI support, agents spend 30% of their time simply searching for information across disconnected systems, says a report from Deloitte. Burnout follows, attrition rises, and customers feel the downstream impact of stressed-out staff.

Why Does Automation Fail in High-Stakes BFSI Moments?

Automation works well for routine queries. But the defining customer moments in BFSI aren’t about checking balances or resetting passwords; they’re high stakes, emotionally charged, and complex. This is where automation-only models’ stumble.

Fraud Alert at Midnight

A customer sees a suspicious debit at 1 AM. They call in a panic, only to encounter a rigid chatbot reciting a script. Instead of reassurance, they get frustrated. Anxiety spikes, and trust in the institution crumbles.

Automation-only systems are built on rules; and rules struggle to keep up with evolving fraud techniques. The explosion of AI-driven fraud such as deepfakes and synthetic identities is outpacing traditional detection systems. In these urgent moments, customers expect not just resolution but reassurance with a “white glove” level of service that balances security with empathy. Deloitte’s projection of fraud losses tripling to $40B by 2027 highlights that static automation cannot adapt quickly enough. Without human judgment layered on top of AI insights, institutions risk falling behind in this arms race.

False Positives in Fraud Detection

In fraud prevention, automation often errs on the side of caution, flagging legitimate customer transactions as fraudulent. While this may look effective on paper, in practice, it damages trust and drives customers away. J.P. Morgan’s findings show that false positives account for ~19% of fraud costs, compared to just 7% from real fraud losses, proving that automation without human review not only frustrates customers but directly undermines profitability.

Insurance Claim After a Crisis

A family devastated by flood damage turns to their insurer. The automated portal offers generic responses, with no recognition of the emotional toll. What they need is compassion, but what they get is bureaucracy. In a recent survey among insured customers: 88% of those who sensed a lot of empathy from their insurer were very satisfied with the claims process; whereas only 10% of those who felt no compassion reported being very satisfied (Carrier Management). Insurers that fail to deliver a white glove level of service here don’t just lose a customer; they risk losing an entire community’s trust.

Mortgage Hardship During a Life Event

A borrower facing job loss reaches out for help. An automated IVR funnels them through irrelevant options, leaving them more helpless than before. What should have been a trust-building conversation becomes a loyalty-destroying one. Today, only 32% of mortgage customers rate their servicer’s communication highly (J.D. Power). That means ~68% feel it’s lacking, particularly when under stress or financial strain, leaving significant room for improvement.

Governance Gaps in Automation

Automation without governance creates dangerous blind spots in compliance-heavy environments like BFSI. McKinseyhighlights that financial institutions must bolster governance when integrating generative AI and automation, as poorly managed systems risk regulatory non-compliance, data leakage, and operational errors of incorrect decisions in KYC, AML, and credit risk. These governance gaps show that technology alone cannot meet evolving compliance demands. Human oversight remains critical to ensure accountability, transparency, and regulatory trust.

In these moments of truth, the absence of a human touch carries heavy costs: lost customers, eroded trust, and reputational damage.

Why Do Augmented Agents Outperform Bots Alone?

The stakes are far too high to leave BFSI customers in the hands of automation alone. Money, trust, and security are on the line. While AI-powered chatbots, self-service portals, and IVR systems excel at routine queries, they often stumble when nuance, judgment, and empathy are required. That’s why the future isn’t AI versus humans; it’s AI with humans.

AI-augmented agents combine the speed and precision of automation with the empathy and contextual judgment only people can provide. Together, they deliver outcomes that consistently reflect a white glove level of service, the kind that builds lasting loyalty.

1. Mastering Regulatory Complexity & Compliance

AI Alone

AI-Augmented Agents

2. Staying Ahead of Fraud & Security Threats

AI Alone

AI-Augmented Agents

Get AI-generated risk scores and context in real time, allowing them to dynamically verify identities with empathy, protecting both the customer and the institution.

3. Navigating Emotionally Charged Interactions

AI Alone

AI-Augmented Agents

4. Managing Complex, Multi-Step Journeys

AI Alone

AI-Augmented Agents

5. Meeting Omnichannel, 24/7 Expectations

AI Alone

AI-Augmented Agents

6. Maintaining Trust in a Digital-First World

AI Alone

AI-Augmented Agents

Superhuman CX in Action: How AI + Human Expertise Drive Better BFSI Outcomes

Customer experience in BFSI isn’t about replacing humans with technology, it’s about creating a seamless partnership between the two. UnifyCX is redefining BFSI support by combining AI-driven efficiency with human expertise to deliver faster, smarter, and more personalized service across the entire customer journey, a solution we call Superhuman CX.

Imagine a world where routine balance inquiries, loan eligibility checks, and policy updates are handled instantly and accurately by conversational AI, freeing agents to focus on complex, high-stakes interactions like hardship assistance, fraud resolution, and claims disputes. This doesn’t just improve customer satisfaction, it protects revenue, strengthens loyalty, and reduces operational strain.

Behind the scenes, UnifyCX AI automates manual workflows and integrates siloed systems, reducing errors and delays so agents can resolve cases with speed and confidence. Our advanced analytics and quality monitoring tools deliver real-time insights that help CX leaders proactively manage compliance, identify risks, and optimize outcomes across every channel.

By blending intelligent automation with human empathy, UnifyCX helps BFSI organizations break down complexity, scale trust-building interactions, and transform their contact centers into strategic growth engines, reducing churn, strengthening compliance, and driving better business results.

With UnifyCX, BFSI support isn’t just about technology; it’s about delivering a white glove level of service while building meaningful, lasting customer relationships that turn every interaction into a loyalty-building moment.

How a BFSI Provider Achieved Centralized Finance with UnifyCX

A major BFSI client was struggling to deliver cost-effective customer care. Demand outpaced their onshore team, calls went unanswered, and frustration threatened retention. UnifyCX implemented a nearshore delivery model with dedicated, security-vetted agents and layered in our AI toolkit: Study Buddy for faster onboarding and continuous learning, Agent Assist for real-time customer insights and next-best actions, 100% QA Monitoring & Coaching to score every interaction and trigger rapid feedback loops, and Voice of the Customer analytics to uncover sentiment trends and upsell opportunities.

A major BFSI client was struggling to deliver cost-effective customer care. Demand outpaced their onshore team, calls went unanswered, and frustration threatened retention. UnifyCX implemented a nearshore delivery model with dedicated, security-vetted agents and layered in our AI toolkit: Study Buddy for faster onboarding and continuous learning, Agent Assist for real-time customer insights and next-best actions, 100% QA Monitoring & Coaching to score every interaction and trigger rapid feedback loops, and Voice of the Customer analytics to uncover sentiment trends and upsell opportunities.

The results were transformative: quality scores consistently hit ~95% (exceeding the 90% goal), over 80% of calls were answered within 20 seconds, and Average Handle Time stayed on target while resolution quality improved. This combination of scale and AI not only improved CX but also boosted retention and unlocked new revenue opportunities, turning a cost center into a growth engine.

Why BFSI Leaders Can’t Afford to Ignore the Human + AI Hybrid Model

The time for incremental change is over; those who lead the charge with human and AI hybrid strategies will set new standards for trust, speed, and resilience in the financial industry. In BFSI, where emotional trust, security, and regulatory rigor intersect, AI-augmented human agents are quietly powering industry leaders ahead. Modern CX transformation means orchestrating the strengths of both, delivering efficiency and speed, but always being ready for human discretion and empathy.